A demand deposit plays a rile here which is defined as a kind of account from where fund can be. These are comprised of proceeds from the disposal of operations CU1300 plus cash received from the sale of property plant and equipment CU440 f Net cash used in financing discontinued operations.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Hedge Fund Analyst Salary and Bonus Levels.

. Hedge Funds Buffetts Berkshire buys more Occidental Petroleum edges closer to 20 stake Suncor Energy SU Enters into Agreement with Elliott Investment Management to Conduct Strategic Review. Tangible vs Intangible Comparison Table Lets look at the top 8 Comparisons between Tangible vs Intangible. The idea is to draw a comparison between two.

While hedge funds invest in anything and everything most of these positions are highly liquid meaning the positions can be readily sold to generate cash. A buyer would have to pay off a firms debt when taking over the firm. Conversely private equity funds tend to.

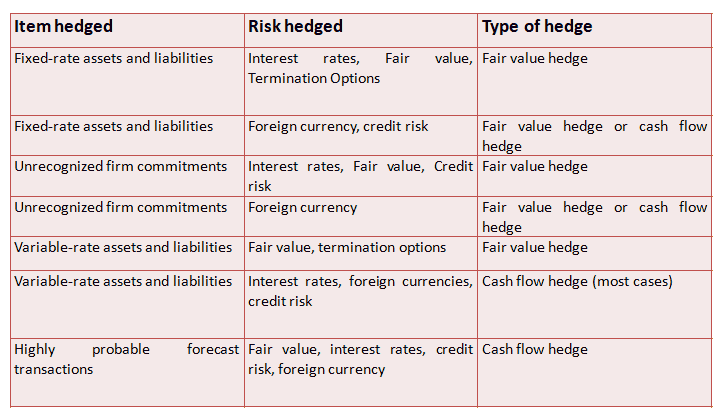

When hedge accounting for cash flow hedge is discontinued the accounting depends on whether the hedged cash flows are expected to occur. At the inception you need to perform the prospective hedge effectiveness assessment. Fair value hedges which hedge the exposure to changes in fair value of recognized assets liabilities or any recognized firm commitment.

Cash stored in the bank account is the best example for this discussion because it is one of the most liquid assets for the company and can be a lot of help for the company to repay back its short-term obligations. This is a typical hedge of the forecast transaction it is a cash flow hedge. Effectively this bank will have guaranteed that its revenue will be greater than it expenses and therefore will not find itself in a cash flow crunch.

Fair value hedge provides you with all the information you need about the benefits and limitations of these useful financial instruments. They perceive gold as a store of value even though its an asset that doesnt produce cash flow. Cash Inflow Forecast.

Raised 2022 full-year guidance on free cash flow1 now expected to be greater than 515 million for the year vs greater than 50 million based on stronger working capital performance and. The second stage is also known as Terminal Value this is the businesss cash flow after the first stage. Focusing on the first two hedging arrangements our comprehensive guide to cash flow hedge vs.

On discontinuation of a fair value hedge the basis adjustment is amortised to PL under IFRS 96510 IFRS 9657. If transaction has not been designated as fair value hedge. This budget takes into account all the probable sources from where the company can earn cash over the budget period.

The most likely range for total compensation at the Analyst level is 200K to 600K USD. And the same could be net off from the cash and cash equivalents available with the firm. The value of tangible assets adds to the current market value but the value gets added to the potential revenue and worth in the case of intangible assets.

- Access to our constantly updated research database via a private dropbox account including hedge fund letters research reports and analyses from all the top Wall Street banks - Notifications for new posts breaking news and comment replies coming soon - Discord-based chat and commentary rooms coming soon. It is defined as money in the form of currency coins and notes. These sources include cash sales cash to be received against accounts receivables cash to be generated from the sale of a fixed asset over the period cash to be earned from the sale of stocks and bonds or any other.

Discontinuation of cash flow hedge. More specifically a speculative hedge fund with an expertise in forecasting future. Cash flow hedges which hedge the exposure to variability in expected future cash flows of recognized assets liabilities or any unrecognized forecasted transactions.

Discontinuation of fair value hedge. Yes I am intentionally using a wide range because of all those factors above. Cryptocurrencys rapid appreciation has many investors questioning the place of stocks in their portfolios.

For fair value hedge we consider hedging gain or loss arising from hedging instruments in profit or loss statement. Another sound approach for computing the value of a firm is to determine the present value of its future operating free cash flows. For a number of reasons a very conservative growth rate is used that cannot exceed that of.

Hedge fund salaries vary a lot based on the fund size type strategy annual performance and other factors. But there are numerous differences between stocks and cryptocurrencies. Cash flow hedge fair value hedge and net investment hedge.

E Net cash generated from investing activities discontinued operations. The derivation takes into account such objective factors as the costs associated with production or replacement market conditions and matters of supply and demandSubjective factors may also be considered such. In accounting and in most schools of economic thought fair value is a rational and unbiased estimate of the potential market price of a good service or asset.

There are three recognised types of hedges. This relates to the repayment of the loan of CU320. Hedge funds which rely on speculation and can cut some risk without losing too much potential reward.

Some see gold as a hedge against inflation as the Feds actions to stimulate the economy.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

On The Radar Hedge Accounting Dart Deloitte Accounting Research Tool

Ifrs 9 Practical Hedge Documentation Template Annual Reporting

How To Determine Fair Value Hedge Or Cash Flow Hedge Under Ind As 109

0 Comments